Barbarians Inside the Gates

The 270 year old mistake that has finally run its course and is now destroying the modern world

Note: This is a summary of a much longer piece I’ve been working on. It may seem tangential to the usual topics on this Substack, but it is in fact fundamental to everything. This post aims to lay out a simple framework for understanding the most important reason why society is slowly collapsing under its own weight. Why people don’t take care of their own health any more, why public health has deteriorated to the sorry shell game that became obvious to most people only during the pandemic, why medical companies have become supremely untrustworthy, why there are so few whistleblowers, and much more that touches on essentially every problem you see around you in every walk of life. Once the root is identified the solution is obvious: cut it out.

Compound interest bearing debt is the foundation of our entire modern economic system.

There are many problems that stem from that beginning with this: compound interest is an exponential function, and closed systems cannot sustain exponential functions.

The exponential nature of debt leads necessarily to inflation of the currency in order to pay it back.

Inflationary price rises lead to society wide short term thinking since the future is now far more uncertain as savings lose value and money tends to be spent rather than saved before it becomes worth less, this leads inevitably to more consumption and less investment in the future and this gradually leads to the collapse of complex civilization back into barbarism, which means ever expanding conflicts, including of course war.

I’m sure I lost some of you somewhere during that chain of consequences, so let’s back up a bit to explain things more clearly.

To begin with it helps to have a clear definition of money, which is after all the basis of all debt obligations.

WHAT IS MONEY?

Money has three characteristics: it is a store of value, medium of exchange and unit of account.

A store of value means that over time you can buy the same amount of goods with the same amount of money. The effort you put into making the money is stored within that money across time and space.

A medium of exchange means that you can exchange money for any good or service.

A unit of account means that you can value things in terms of money. For example you need to get eggs and all you have to exchange are paperclips. How many paperclips is an egg worth? If they are both valued in terms of the same unit of account, i.e. money, then you can easily figure it out.

Gold has served the purposes of money for more than 5000 years because it is valued by all, so is a good medium of exchange.

It served well as a unit of account since it could be broken down into smaller or larger bits in order to assign a gold value to any good or service.

It also works well as a store of value since it’s difficult to increase the amount of gold in the system.

People tried using other things like beads and seashells and bits of animal hide.

The problem with all those was anyone could easily make them and buy up everything in the market and then the economy fell apart.

Historically gold supplies increase over time at about 2% or less per year and tend to lag behind the population growth rate.

So the per capita amount of gold in the system - the amount per person living tends to slowly decrease over time.

That sounds bad, but what it means is that it becomes more precious over time, i.e. it can buy more stuff, which is not so bad after all.

In fact it’s quite good. It means that if you save you get rewarded. Without any bank having to pay you interest.

What we have described in gold is referred to as hard money, simply because it is hard to make more of it.

On the other hand, easy money like the seashells, beads and bits of hide can be created very easily, and so it is: e.g. nowadays passing versions of those could be made with a 3D printer rather than a pick and shovel and a lot of luck.

If you could legally print real non-counterfeit money wouldn’t you?

Bankers can and do.

This inflates the supply and makes prices go up. Not so good for savers.

So, now that we know what money is, both hard and easy, let’s talk about our money.

New dollars can only be created in two ways:

when the US federal government takes on new debt from the Federal Reserve Bank, which creates the dollars from nothing at all, or

when other fractional reserve banks issue new loans.

So the dollar is a form of easy money.

The dollar, technically a Federal Reserve Note, i.e. promissory note, i.e. debt instrument, is in simple words a compound interest bearing debt contract.

The US government sells a bond called a US Treasury Bill to the US Central Bank, AKA the Federal Reserve Bank, which pays with the magic money from thin air called the dollar. Since there is a compound interest rate on the debt contract the US government has to pay back more than it borrows over time.

Where does that “more” come from?

This is where the other fractional reserve banks come in. They have to keep a certain amount in reserves and then they can also lend out newly created magic money dollars to anyone who qualifies. If the reserve requirement is, say 10% it means for every magic dollar they have in reserve they can create nine new dollars from nothing.

Those debt contracts have compound interest rates on them too, which means the borrowers will owe more than they borrow over time.

Where does that new money come from? More magic money dollars will have to be created from nothing at some point in the future.

Now that we have a clear picture of money which is the subject and basis of debt obligations we can talk about compound interest on debt.

COMPOUND INTEREST

The fundamental problem with compound interest is it’s an exponential function: which means it has a set doubling time.

In the graph above the doubling time is every day. In the real world doubling times for debt are measured in years.

But the principle is the same, it’s just a matter of how long it takes to get from the left side of the red line to the right side.

Exponential functions can seem reasonable at first - most of the red line above, but later on they take a hockey stick turn upwards towards infinity so fast that once it begins its suddenly over.

Another illustrative example over a longer timeframe: an ounce of gold at 5% yearly compound interest over 1200 years would end up weighing more than the entire Earth.

Obviously such an exponential system is unsustainable with finite resources.

On a sound money gold standard that historically inflated at or less than 2% a year it was mathematically impossible to pay back interest above that minimal rate of inflation since there just wasn’t enough money (gold) in the system.

In order to pay back exponentially rising debts money was forced to become inflationary.

Governments had to trim the edges off their gold coins so they could add more supply to pay off their debts.

When even that became impossible they mixed lesser metals into the coins, then completely switched money away from precious metals, then resorted to printing paper money, and finally we have arrived at the ultimate inflationary unit of account, not even limited by the amount of paper and ink on the planet: electronic money.

No, not crypto: the vast majority of modern dollars in existence are simply electronic ledger balances in a central computer.

The problem with that is there is no free lunch: it lowers the value of each unit, which we call inflation.

Which means it takes more and more dollars to buy the same stuff.

This is a surreptitious theft of savings, or a hidden tax - those on fixed incomes get priced out of markets over time.

If it was really so bad you would think we would have long ago realized it and put an end to it.

And you would be right.

HISTORICAL VIEWS OF INTEREST

Jesus famously threw the money lenders out of the temple.

The Bible itself says in Deuteronomy 23:19:

“You shall not charge interest on loans to your brother, interest on money, interest on food, interest on anything that is lent for interest. You may charge a foreigner interest, but you may not charge your brother interest, that the Lord your God may bless you in all that you undertake in the land that you are entering to take possession of it.”

Though there is some ambiguity amongst the Bible’s verses that deal with interest the Catholic Church did not allow interest until the mid 1700s.

The Jewish scriptures say it’s one of the worst sins.

The Muslim scriptures agree:

Quran 2:278-9:

“O you who have believed, fear God and give up what remains [due to you] of interest, if you should be believers. And if you do not, then be informed of a war [against you] from God and His Messenger.”

I know what you’re thinking.

The Abrahamic faiths do tend towards an eye for an eye and all, but war seems a rather extreme overreaction, doesn’t it?

We’ll come back to that.

Christian philospher St Thomas Aquinas attempted an explanation for the prohibition of interest in his Summa Theologiae, arguing essentially that money, unlike say a house, is a consumable good - in the sense that its use lies in consuming it, similar to food.

If you lent someone some milk you would expect them to consume it and return you the same amount of milk later.

With a house you could sell it outright or you could charge someone rent for the use of it over time since it is not a consumable good.

But with money, as with milk, you can only lend it out expecting it will be used since that’s the whole point of a loan of milk or money in the first place and therefore you can only expect the same amount in return.

Since if you tried to also charge an additional fee for using it you would be trying to sell something extra that doesn’t actually exist, which would be unjust.

The idea being that the use of the money or the “time value” of money is not a feature of money that is separate from its nature and therefore cannot be sold separately.

Even the Ancient Greeks knew there was something wrong with interest. Aristotle wrote:

“The most hated sort [of moneymaking], and with the greatest reason, is usury, which makes a gain out of money itself, and not from the natural use of it. For money was intended to be used in exchange, but not to increase at interest. And this term Usury which means the birth of money from money, is applied to the breeding of money, because the offspring resembles the parent. Wherefore of all modes of making money this is the most unnatural.”

BUT IT WORKS SO WELL NOWADAYS, RIGHT?

But what’s really so wrong with making money this way?

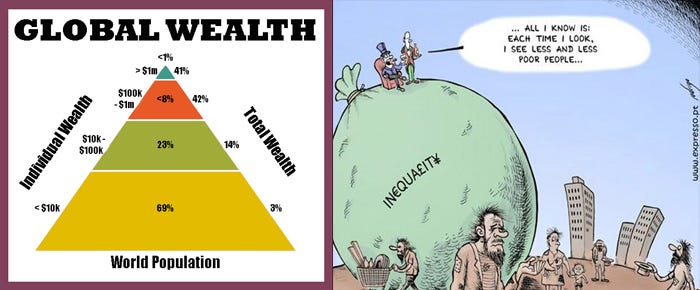

Over time lending acts to concentrate wealth in the hands of a tiny minority because some percent of people will always default.

Some percent will always lose their collateral.

Some percent will always lose their house, car, or business and then the lenders rinse and repeat with a new cohort of borrowers from whom once again a certain percent will be unable to pay back their debt, will lose their collateral, ad infinitum, but not quite, since there are only so many people to turn into paupers.

As prices keep rising with inflation more and more people resort to debt to sustain their lifestyles and more and more will default and the lenders repossess more and more wealth, until eventually, even if it takes generations, at some point all the wealth has concentrated in a few hands and the bankers have finally reinvented serfdom or slavery.

Money goes from being spread out amongst people and a useful store of value and medium of exchange to being primarily a unit of account and a plaything of the rich, which they speculate and hoard, since the poor have very little of it to exchange for anything and it no longer stores value effectively.

Which brings us to the inevitable conclusion, which has of course been foreseen by those in the know:

“You’ll own nothing. And you’ll be happy”

BARBARIANS INSIDE THE GATES

And what’s perhaps even worse than inflationary theft and serfdom is that when people see the purchasing power of their savings evaporating faster and faster due to inflation, they become more and more short sighted over time - better to buy stuff now rather than save for the future, or better to “invest” in something, anything, even some hair brained scheme before my money loses any more value.

Short term thinking means you prefer erecting cheap throwaway buildings with high maintenance costs over more expensive ones with lower maintenance costs that will stand for millennia.

It means you prefer entitlements or outright theft over long years of education and hard work; casual sex over marriage; cheating over playing fair and building a good reputation; eating junk food or popping a pill over taking care of yourself; destroying the topsoil over regenerative farming; spewing toxic, obesogenic, carcinogenic pollutants for short term gains over thoughtful stewardship of the environment; cutting corners and pushing out toxic products that kill people without properly safety testing them, etc.

But maybe I’m getting ahead of myself.

Inflation obviously affects purchasing behavior. But can inflation really drive all of the above?

The idea of money, specifically its aspect as a unit of account is like software in the brain.

Money is what we use to assign value to everything in the world and to everything that we do and inflation is like a bug that infects the code.

If money maintains or even gains value over time, as gold has historically done, people can rest easy knowing that if they set aside a certain percentage of their income, the value of their labor will be safely stored in that wealth across time, even into the distant future.

This security means that they can begin to invest any surplus into building a better future for their descendents.

Take for example an early fisherman a thousand years ago who catches enough to feed his family and sells the rest for gold.

He sets aside some gold as savings for a rainy day, and takes another portion of it and invests it into a small fishing boat so he can catch more fish.

He is now able to save more and invest more, eventually he upgrades to a larger fishing boat with better equipment and catches even more fish.

His descendants continue to expand their fleet of boats and in the age of industrialization invest huge sums into truly massive infrastructure - huge boats, factories, trucks, processing plants, etc.

All of this infrastructure is what is called capital in economics. Capital builds up in a civilization over time beginning with the earliest savers and investors continuing on down to the present day.

We still benefit from the accrued capital due to the savvy investment decisions of our ancient ancestors, which were enabled by the use of sound money that stored value across time.

But now money no longer holds its value and people are no longer incentivized to save anything, because it will simply evaporate.

Since money now inflates so fast, more and more money enters the economy chasing the same amount of sound investments (which can’t be printed up on demand) and the prices skyrocket.

Things like real estate become savings accounts for the rich and price the poor out of homes.

It becomes increasingly difficult to beat the rate of inflation by choosing sound investments so people either simply lend out their money for a safe return or invest it into highly speculative ventures in the vain hope of simply preserving their purchasing power - what used to be taken for granted with gold.

Economic activity shifts from productive work that creates things people value to elaborate games played by the wealthy with financial derivatives that become further and further divorced from anything real.

So the building phase of civilization grinds to a halt and the tearing down phase begins. Infrastructure is not maintained, it falls into disrepair and eventually capital that took generations to save up begins to be eaten away for current consumption.

Just as people find it less appealing to invest in businesses so they find it less appealing to invest in themselves with education in the face of an increasingly uncertain future.

They also find it less appealing to invest in relationships, children, their health, and their reputation.

Attention spans shorten. Entitlements and crime become rampant.

Jobs pay less in real terms and people begin to despair, dissipating themselves with drugs and pastimes.

As people cut more and more economic corners they psychologically normalize misbehavior and start to cut corners everywhere else.

People begin to value instant gratification over delayed satisfaction.

Companies find it harder and harder to make an honest buck as inflation erodes their profitability.

They also have to cut corners, dilute quality, start to cheat, buy congressmen, change the rules.

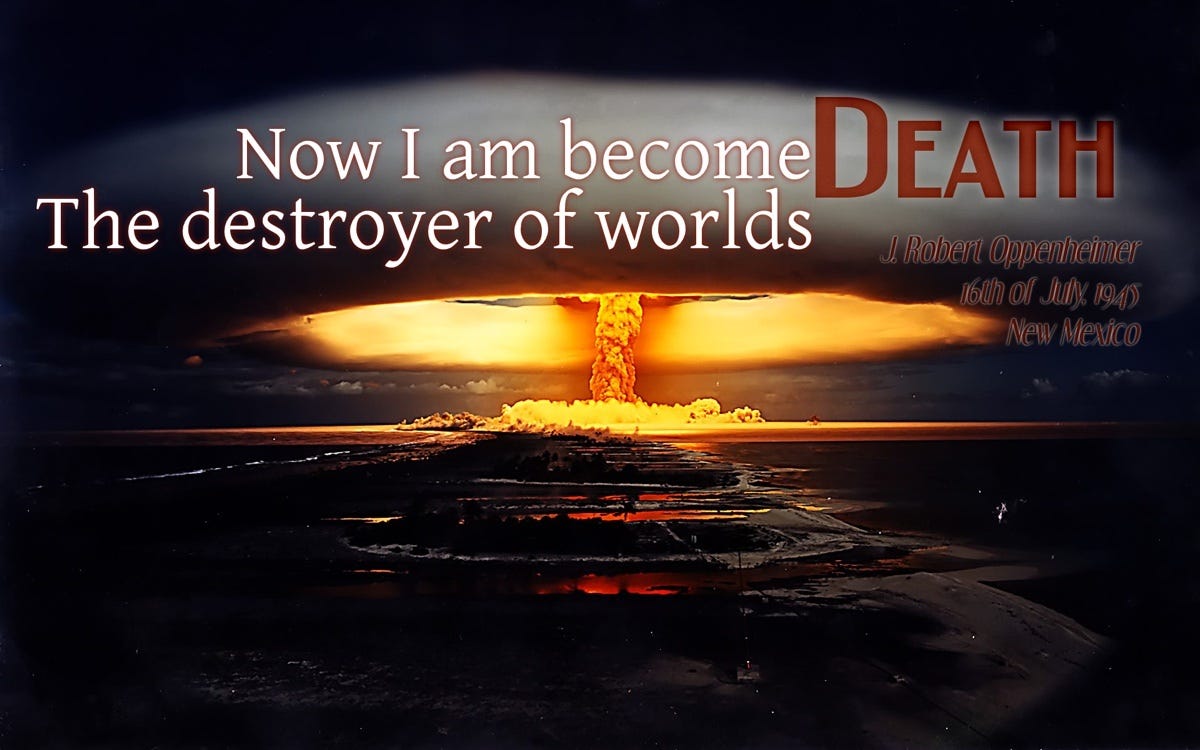

This rampant short term mindset is the opposite of what it takes to build a long term ever-advancing, ever-developing civilization.

It is de-civilizing.

It is Shiva the Destroyer of Worlds.

Because if the rest wasn’t bad enough the worst manifestation of inflation and interest bearing debt and a short term mindset is outright war.

When governments were limited to real money like gold for financing wars, they fought less, negotiating instead, or having their chosen champions fight it out to determine the outcome.

Anything and everything to avoid wasting finite treasure.

As wealth concentrates in the hands of a tiny minority and poverty becomes widespread the short term solution at hand is to go out and get yours from someone else.

Go and get their oil, get their resources, their mines and land, subjugate them, force them to produce for you, strip mine them for what you need to sustain your civilization.

And now we’re back to where we started. Hopefully this time it makes more sense:

Interest based debt creates inflationary currency which creates short term thinking and acting which destroys civilizations not least by leading inevitably to war.

That’s why our ancestors outlawed interest.

If you look at their philosophical explanations from our vantage point they seem quaint and unpersuasive, arguing about what is natural or not, whether it makes sense to charge rent on money or not given it is more similar to a consumable good than a home, etc.

The dogmatic religious prohibitions seem the most quaint of all, with source scriptures often lacking any explanation whatsoever, though they clearly represented a deep civilizational wisdom passed down from time immemorial like the pervasive worldwide myth of the Great Flood found in widely disparate religions and cultures.

And it turns out they were all right, while we have been as the silly frog in the pot with the temperature slowly rising, thinking everything is just grand.

Now we have reached the boiling point and what may have been unclear to past peoples should be quite clear to us: just why interest is actually so destructive.

Some people say it must be the loss of religion, others the lack of education, others complain about broken families, or capitalism, or consumerism, or narcissism.

Sure, all of those things are a part of it, but what devil is in the driver’s seat?

Everyone knows there is something seriously wrong with the world, but not everyone can explain it. Hopefully now you can.

WHAT’S THE SOLUTION?

Interest bearing debt fueled economies have to expand exponentially otherwise they collapse. The problem is we live on a finite planet. We can’t practically expand to fill the universe. There is just so much economic value we can create to repay the exponentially rising debts we have built up. This will all collapse very soon.

Historically the answer has been to have a debt jubilee: waive all the existing debts and start over. We will be forced to do that eventually. It is a mathematical certainty. It happens every time.

But that doesn’t solve the extractive, exploitative underlying problem of ever increasing wealth concentration and inequality.

It doesn’t solve the inflationary effect on the monetary system and the pervasive negative effect that has on our individual and collective psychology, making people gradually more short term oriented, less able to build for the future.

It doesn’t actually solve anything, it just keeps the game of musical chairs going.

And it’s not just compound interest that is the enemy as the ancients well understood: if you open the door to simple interest, it’s a slippery slope: compound interest will come soon enough, as we have seen in the last 400 years as the West first allowed interest and then was slowly devoured by it.

INTEREST IS WAR

Interest is war on humanity, a war against the world, a war against God, a war against everything good.

Which is why the ancient Law of Talion applies, a War for a war: a War from God, for a war against everything.

You are not a warmonger. So stop waging this war.

Stop using interest and tell everyone else to stop using it. Tell your family and friends, your neighbors and coworkers, your congressman, your senator, your mailman.

Share this far and wide, print copies, republish it in your local newspaper.

Do whatever you can to put an end to it before it’s too late.

![What Does 18k Gold-Plated Mean? [All You Need To Know!] - StyleCheer.com What Does 18k Gold-Plated Mean? [All You Need To Know!] - StyleCheer.com](https://substackcdn.com/image/fetch/$s_!XBC1!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd5eb59e1-6b61-4f7d-92dc-a6cf49d5850b_1200x800.jpeg)